Protecting your Personal Access Code (PAC)

Just as you play a vital role in ensuring the security of your home and your possessions, you too share in the responsibility for ensuring that your personal information is adequately protected. To ensure that you are the one accessing your accounts, we need a unique way of knowing that it's you. Just as the key to your home protects unwanted entry, the online banking Personal Access Code (PAC) and Increased Authentication challenge questions - ensures that only you can access your accounts.

It is your responsibility to ensure that your PAC and the answers to your challenge questions in the online section of this website are protected. Please observe the following security practices:

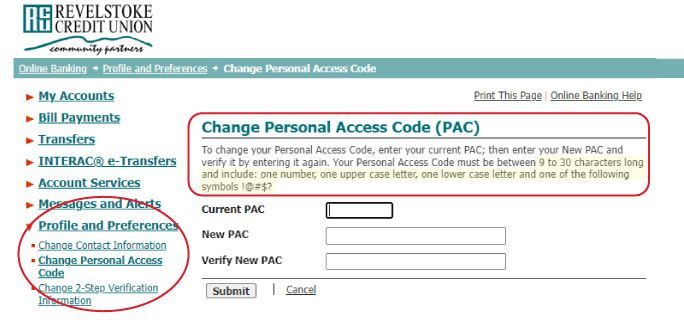

• Select a PAC that is easy for you to remember but difficult for others to guess. For example, never use obvious PACs such as 12345.

• When choosing a PAC do not select a part of your ATM card PIN or another password.

• Keep your PAC confidential and do not share it with anyone.

• Do not write your PAC down or store it in a file on your computer.

• Never disclose your PAC in an email message, and do not disclose it over the phone.

• Ensure no one observes you typing in your PAC at ATMs or Interac Direct Payment merchant terminals.

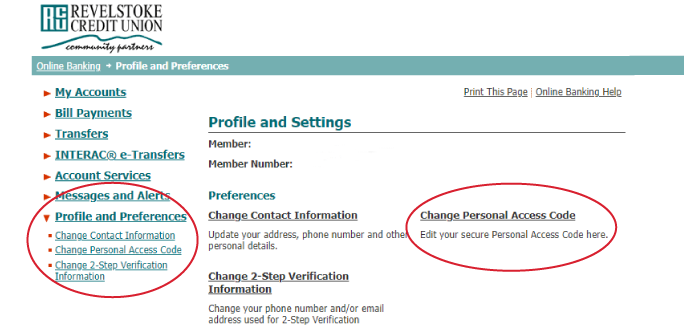

• Change your PAC on a regular basis. We suggest every 90–120 days.

• When selecting challenge questions, choose questions that only you would know the answer to.

• Keep the answers to your challenge questions confidential and do not share them with anyone.

• Do not write your challenge questions and answers down or store them in a file on your computer.

• Never disclose your challenge questions and answers in an email message, and do not disclose them over the phone.

• Ensure no one observes you typing your challenge question answers on a computer, tablet or other online banking devices.

• Change your challenge questions and answers on a regular basis. We suggest every 90–120 days.